On Jan. 9, the U.S. Securities and Exchange Commission’s (SEC) Twitter account was compromised, leading to a false announcement of a spot Bitcoin ETF approval. This caused significant fluctuations in the derivatives market for Bitcoin (BTC) and Ethereum (ETH), resulting in over $50 billion in Bitcoin’s market capitalization being wiped out.

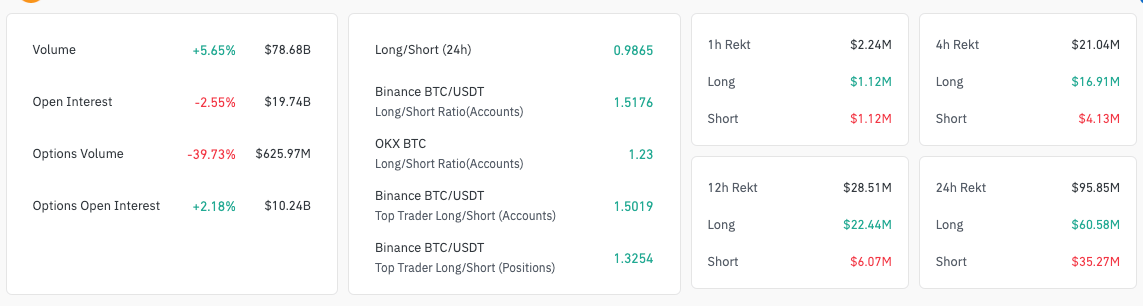

The overall trading volume in the derivatives market increased by 8.52% to $79.02 billion, reflecting the market’s response to the fake news. However, open interest decreased by 2.78%, suggesting that many traders were closing their positions amid the uncertainty.

Bitcoin options volume dropped by 39.73%, but open interest slightly increased by 2.18%. The market also witnessed $95.41 million in liquidations, with long positions accounting for $59.39 million and shorts for $36.02 million, indicating a bearish market reaction.

Despite the decrease in open interest on Binance and Bybit, the two largest exchanges, there was an increase in trading volume, indicating heightened activity and a trend of traders closing positions in a volatile environment.

| Symbol | Price | Price (24h%) | Volume (24h) | Volume (24h%) | Market Cap | Open Interest | Open Interest (24h%) | Liquidation (24h) |

|---|---|---|---|---|---|---|---|---|

| BTC | $44911.2 | -4.01% | $77.66B | +5.23% | $884.97B | $19.66B | -3.59% | $94.36M |

| ETH | $2375.65 | +4.47% | $41.18B | +77.57% | $285.82B | $7.78B | +10.67% | $49.30M |

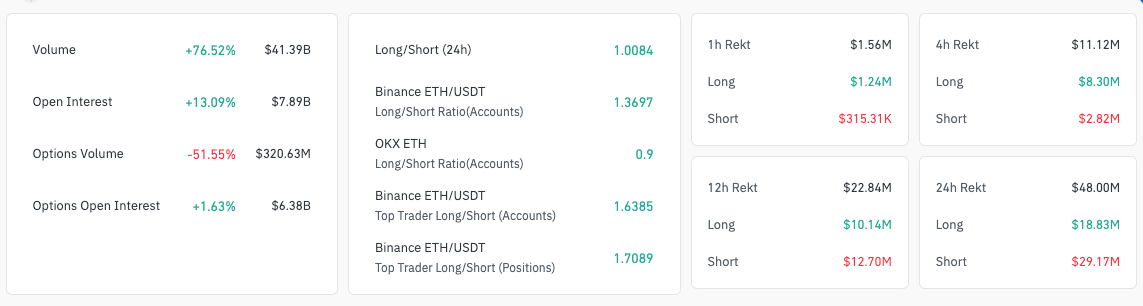

In the Ethereum derivatives market, trading volume surged by 79.85% to $41.30 billion, while options volume decreased significantly by 51.55% to $320.63 million. Traders may have been more inclined to engage in futures contracts rather than options trading in uncertain conditions.

Open interest in Ethereum increased by 11.52% to $7.81 billion, contrasting with the pattern observed in Bitcoin. This suggests a more bullish sentiment in the Ethereum market, or at least a perception of Ethereum as a more stable asset in the face of market shocks.

The post Ethereum takes the lead over Bitcoin in derivatives trading volume appeared first on CryptoSlate.